Economic crime poses a growing threat to the economy and the integrity of financial systems. These crimes include money laundering, fraud, corruption, violations of sanctions, counterfeiting, and related financial investigations and asset recovery. Economic crime targets individuals, businesses and public institutions.

Swindling and fraud

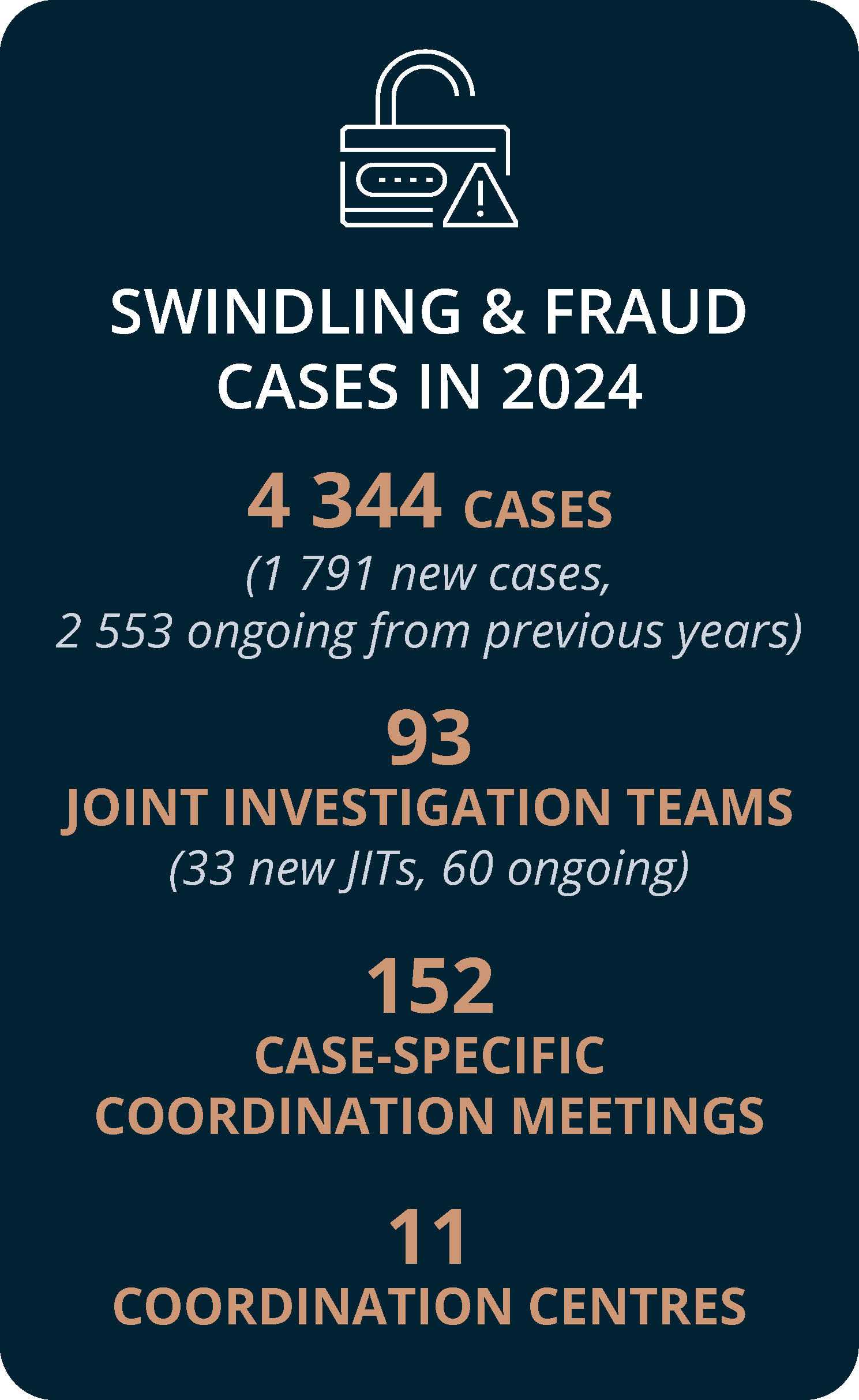

Swindling and fraud remained the top crime type addressed by Eurojust in 2024. The Agency handled 5% more swindling and fraud cases in 2024 compared to the previous year. Moreover, Eurojust supported 40% more action days, 35% more JITs and 20% more coordination meetings in this area compared to 2023.

Greece, followed by Italy, was the country that initiated the most swindling and fraud cases at the Agency in 2024. Switzerland, followed by Ukraine, was the third country that opened the highest number of such cases. Germany, followed by Spain, was the country most frequently requested to participate in cross-border swindling and fraud cases in 2024, while the United Kingdom, followed by Switzerland, was the third country most frequently requested to participate in such cases.

Throughout the EU, thousands of victims continued to be targeted by fraud schemes put in place by criminal organised groups (e.g. investment fraud and food fraud). These complex multilateral investment fraud cases required judicial cooperation, facilitated by Eurojust, particularly in relation to centralising proceedings at the national and international levels, avoiding conflicts of jurisdiction, prioritising common suspects for prosecution and compensating victims.

Throughout 2024, Eurojust continued to protect the EU’s financial interests within its mandate, in cooperation with EPPO and other partners, by supporting ongoing investigations and participating in EMPACT. The Agency also continued to support numerous excise fraud investigations, and fostered cooperation and exchanges among practitioners in relation to Missing Trader Intra-Community fraud.

Money laundering

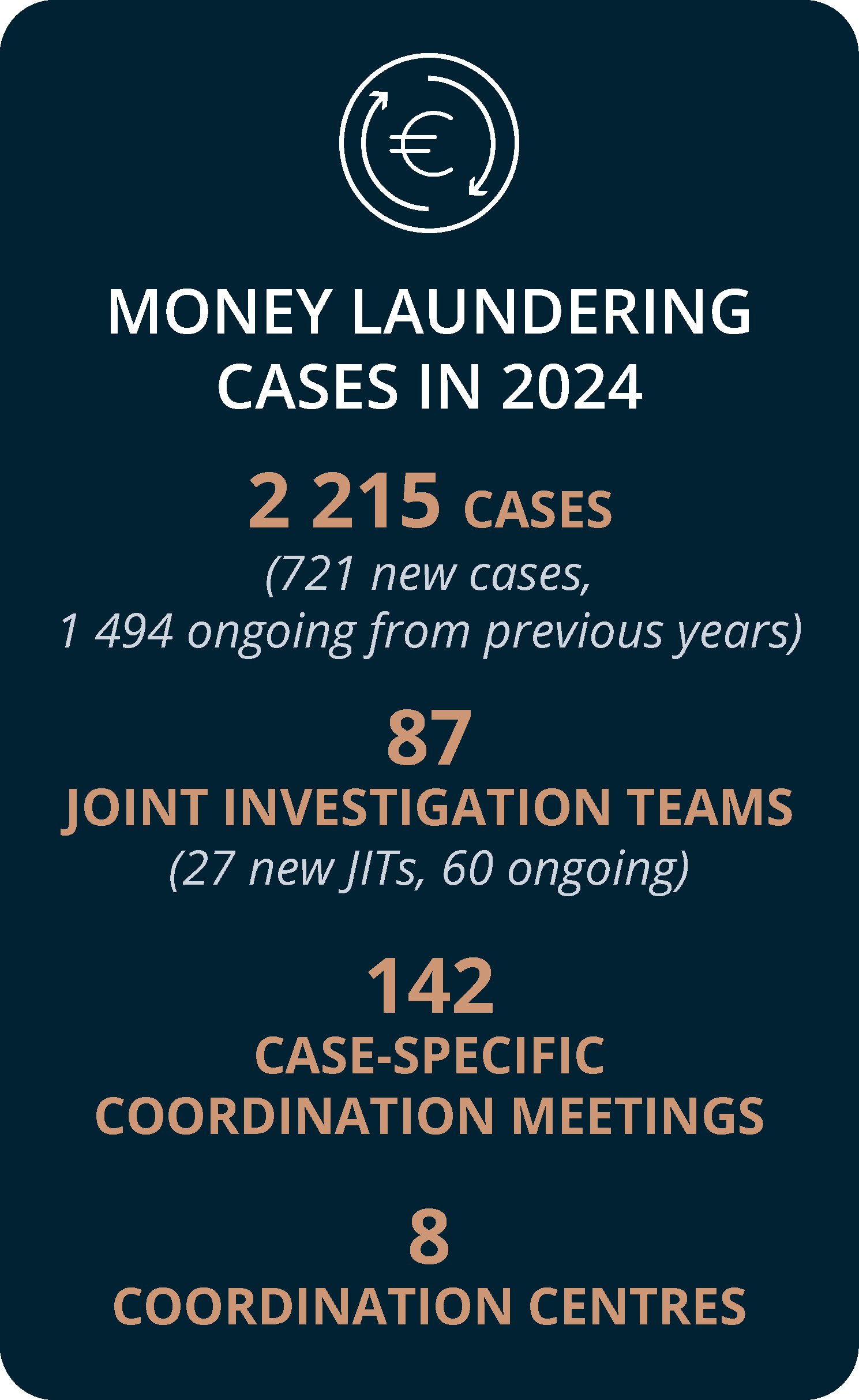

As in previous years, money laundering featured among the top three crime types addressed by the Agency in 2024. More than 2 000 money laundering cases were handled, including over 700 newly opened in 2024. The number of JITs in this area grew by 25% in 2024 compared to the previous year.

Some recurring issues addressed in Eurojust’s casework in 2024 concerned the following: dual criminality and predicate offences, the sale of cryptocurrencies during the asset recovery process, hawala[1] and underground banking, the mixing of legitimate and illegitimate profits, and money laundering services through financial institutions.

The Agency also supported national authorities in coordinating the exchange of information at the national and international levels between prosecutors, judges, asset recovery and asset management offices, financial intelligence units, law enforcement agencies, crypto experts and financial investigators.

In November 2024, Eurojust set up a new Judicial Focus Group on Money Laundering and Asset Recovery. The Focus Group is composed of national prosecutors and judges involved in the investigation and prosecution of money laundering and the recovery of criminal assets. The Focus Group will provide judicial authorities with guidance on post-conviction financial investigations, exceptional costs concerning the execution of freezing and confiscation orders, and restitution to or compensation of victims. Eurojust is uniquely placed to coordinate this international platform and will ensure the group’s collaboration with the European Commission, EU agencies/bodies, international partners, and the EU Freeze and Seize Task Force in the field of EU sanctions.

In May 2024, the European Commission’s package of legislative proposals to strengthen the EU’s rules on anti-money laundering and countering the financing of terrorism was adopted. The scope of the Transfer of Funds Regulation now also extends to the transfer of crypto-assets. Moreover, in June 2024, the Anti-Money Laundering Authority (AMLA) was established. It is responsible for anti-money laundering and countering the financing of terrorism measures at the EU level, and also supports Financial Intelligence Units. Under the terms of the Regulation, the AMLA will share the results of financial intelligence analyses with Eurojust to enable the Agency to exercise its competence.

Corruption

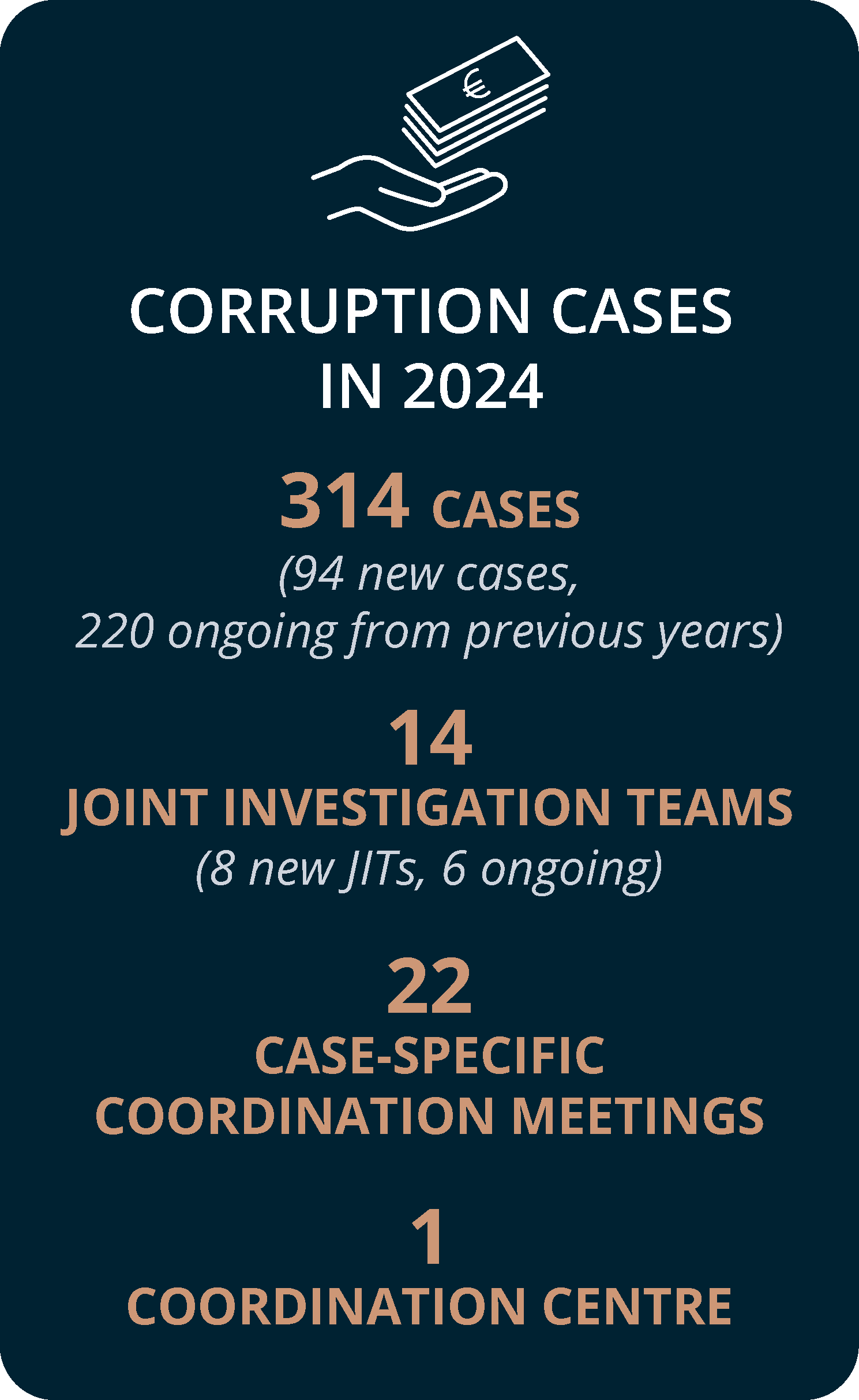

Corruption is a key enabler of most criminal operations, with 60% of the criminal networks operating in the EU using corrupt methods to achieve their illicit objectives.

In 2024, Eurojust supported more than 300 corruption cases, around one third of which were newly referred to the Agency during the year. Eurojust supported almost twice as many corruption-related JITs in 2024 compared to 2023, more than half of which were newly established in 2024.

Greece, followed by Romania and Italy, was the country that initiated the most corruption cases at Eurojust in 2024. Albania, followed by Ukraine, was the third country that opened the highest number of such cases. France, followed by Germany, was the country most frequently requested to participate in cross-border corruption cases at the Agency in 2024, while the United Kingdom was the third country most frequently requested to participate in such cases.

During the year, Eurojust continued to participate in the European Commission’s EU network against corruption, which brings together law enforcement agencies, public authorities, practitioners, civil society and other stakeholders to ensure prevention and develop best practices and guidelines to fight corruption effectively.

Euro counterfeiting

Eurojust handled 25 euro counterfeiting cases in 2024, a third of which were newly opened during the year. The Agency also supported a new JIT, as well as four coordination meetings to assist investigations in this area.

Eurojust handled 25 euro counterfeiting cases in 2024, a third of which were newly opened during the year. The Agency also supported a new JIT, as well as four coordination meetings to assist investigations in this area.

A current challenge is the increasing circulation of a highly deceptive type of counterfeit money – so-called ‘movie money’, prop copy products and other banknotes with altered designs. At present, there is no common judicial approach in the EU Member States to prosecute criminals involved in the production and distribution of these counterfeits.

Another challenge relates to the establishment of effective cross-border judicial cooperation with non-cooperative third countries that are major exporters of counterfeit euro banknotes, coins and raw materials for the production of counterfeits.

In 2024, Eurojust continued to participate in the work of the Euro Counterfeiting Experts Group – a coordination platform led by the European Commission for anti-counterfeiting measures, bringing together experts from Member States, the European Central Bank, Eurojust, Europol and Interpol. Moreover, the Agency participated in the third EU-China platform meeting on the protection of currencies against counterfeiting, and together with Europol, hosted a study visit of the Chinese delegation.

PIF crime

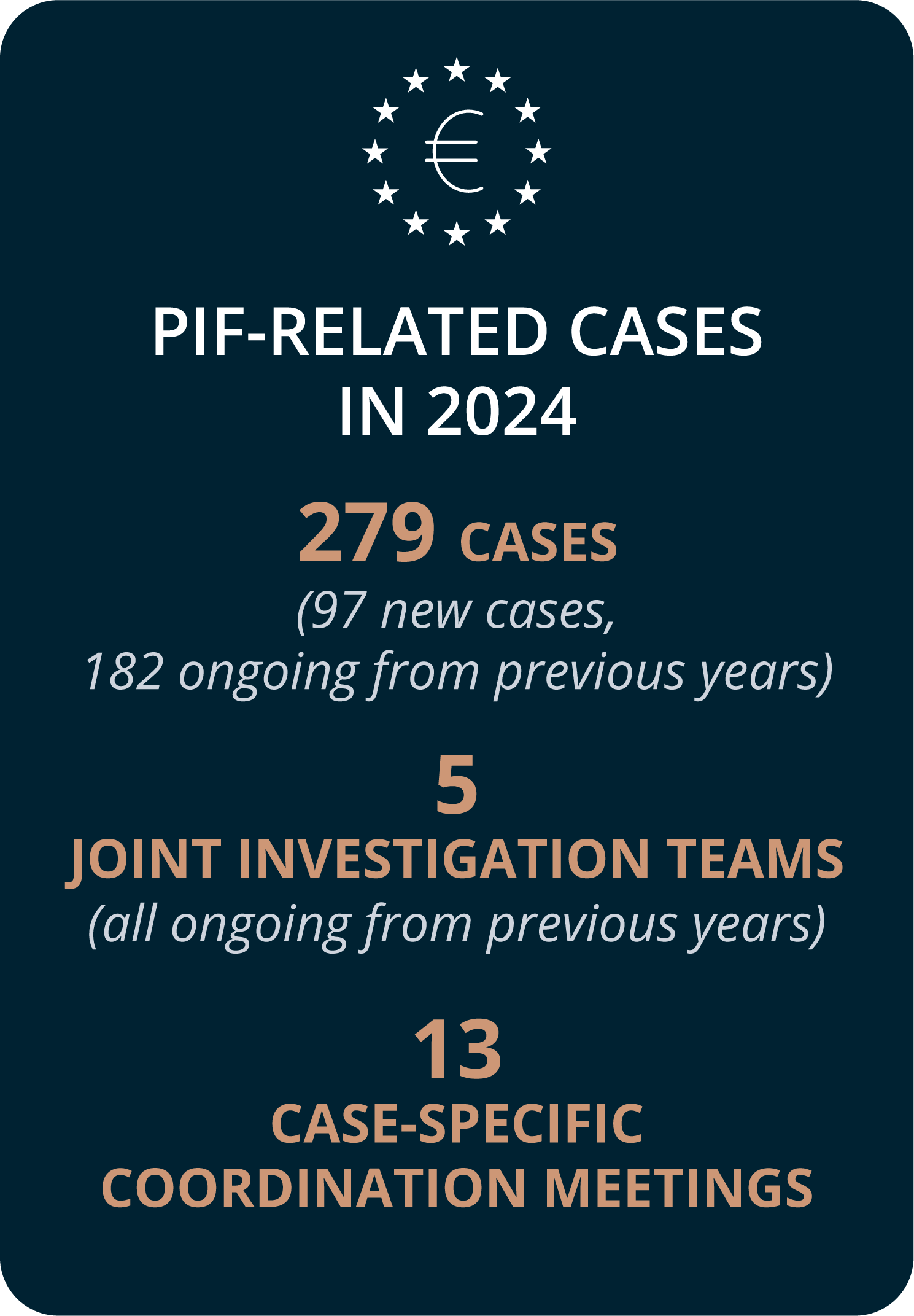

Eurojust supported slightly fewer PIF-related cases (crimes against the financial interests of the EU), JITs and coordination meetings in 2024 compared to the previous year. Approximately one third of the 279 cases handled by the Agency were newly opened in 2024.

Eurojust supported slightly fewer PIF-related cases (crimes against the financial interests of the EU), JITs and coordination meetings in 2024 compared to the previous year. Approximately one third of the 279 cases handled by the Agency were newly opened in 2024.

Italy, followed by Bulgaria and Belgium, was the country that initiated the most PIF-related cases at the Agency in 2024. Germany, followed by Spain and Lithuania, was the country most frequently requested to participate in cross-border PIF-related cases at Eurojust in 2024.

In 2024, Albania, North Macedonia, Switzerland, Ukraine, the United Kingdom, and the United States were the third countries involved in PIF-related cases at the Agency.

Financial investigations and asset recovery

Depriving criminals of the proceeds of crime by freezing and confiscating criminal assets is highly effective in fighting organised crime and also a powerful deterrent. Eurojust has built up substantial institutional knowledge of solutions and best practices that can significantly improve the effectiveness of investigations, prosecutions and ultimately the recovery of criminal proceeds.

In 2024, the Agency continued to support national authorities in the practical application of the Regulation on mutual recognition of freezing and confiscation orders. Some issues addressed in Eurojust’s casework in 2024 concern the direct applicability and scope of the Regulation, time limits, restitution to victims, exceptional costs, freezing of cryptocurrencies, affected persons and concurrent certificates.

The Directive on asset recovery and confiscation, adopted in April 2024, will significantly impact Eurojust’s asset recovery casework. The Directive introduces EU-wide minimum rules on tracing, freezing, confiscating, disposing of and managing criminal property in connection with a wide range of crimes.

Violation of EU sanctions

Eurojust continued to support an increased number of cases related to the violation of EU sanctions and related crimes. In 2024, a number of challenges were identified by national authorities concerning the violations of sanctions, and in particular, the illicit flow of sensitive technology. The use of shell companies, including those in third countries, to circumvent sanctions makes the investigations highly complex and challenging. The adoption in May 2024 of the Directive on the definition of criminal offences and penalties for the violation of Union restrictive measures has had an impact on the rise of cases in this sensitive area.

EU Freeze and Seize Task Force and sanction evasions

In 2024, Eurojust continued to exercise its coordinating role in the EU Freeze and Seize Task Force, established by the European Commission to ensure the efficient implementation of EU sanctions against listed Russian and Belarusian oligarchs across the European Union in connection with the Russian invasion of Ukraine.

Eurojust continued to cross-check the list of individuals and companies sanctioned by the EU against Eurojust’s data, identifying and confirming several new links. The Agency also supported cases of violations of EU sanctions. It continued to collect relevant information at the national level on past and ongoing investigations related to persons on the sanctions list to facilitate criminal proceedings and identify legal and practical obstacles that may hinder the confiscation of assets owned or controlled by the listed individuals and companies.

Throughout 2024, the Agency continued to participate in Operation Oscar, led by Europol, to support the freezing of criminal assets of persons and entities sanctioned by the EU and to provide judicial cooperation support to national authorities.